In a first for union-affiliated construction companies in Michigan, Granger Construction Company has established a 401(k) retirement savings plan for union employees. This benefit plan is a vehicle to assist with long term retirement preparation and coexists with the pension plan currently provided to you. You will have the ability to defer a pre-tax portion of your gross pay each week into your retirement fund. In addition, Granger will match a portion of your savings to help your account grow more quickly.

Granger believes skilled trade jobs through union organizations are the backbone of the construction industry. The Company realizes that pension plans offered for retirement are less stable than in the past, therefore we have established this program to support our employees, their families, and their futures.

How to Make Changes

Calculating a Deferral Contribution Change

Roth 401(k) Common Questions

Program Overview

Read More »Program Details

Read More »Frequently Asked Questions

Read More »Overview

Read More »Program Overview

- A 401(k) plan is a retirement savings plan that allows participants to defer savings from their gross pay (tax free) into an account that grows over time via investment funds.

- This plan operates in addition to the pension plan offered through your respective union organization. You are eligible to participate in both.

- Individuals employed at Granger for 6 months or more are eligible to participate in the plan.

- In addition, Granger offers a Roth 401(k) option as well. With a Roth 401(k), you contribute after-tax dollars, your account grows tax-free, and you can generally make tax- and penalty-free withdrawals at age 59 ½. With a Traditional 401(k), you contribute pre-tax dollars, but withdrawals are taxed as ordinary income in the year you take a distribution.

Program Details

Enrollment: All current employees will be contacted by Human Resources approaching their eligibility date.

Investment Options: Upon enrollment, your contributions are automatically placed into an investment find based upon your estimated retirement year. There are many fund options available for investment purposes and you have the freedom to make adjustments at any time.

Contribution Percentage: Upon enrollment, you can contribute a percentage of your gross pay into your 401(k) account at a maximum of $22,500 per year. After the initial enrollment period, changes to deferral percentages are only allowed on January 1 and July 1 each year.

Matching Contributions: In addition to your gross pay contributions, Granger provides a 100% match of your deferrals, up to a maximum of $2,080 per year. The matching funds are deposited during the months of January or February, following the conclusion of the prior year. All matching and discretionary contributions from Granger will be deposited into a pre-tax (Traditional) account, even if you only defer into the Roth 401(k).

Long-Term Retirement Savings Account: The funds you defer and invest will grow over time. Simply contributing the minimum of 1% of your pay and receiving the matching funds from Granger could result in your account achieving balances of:

- $54,832 >> after 10 years

- $153,028 >> after 20 years

- $328,882 >> after 30 years

Of course, your actual account balance will be a function of how much you contribute, what funds in which you choose to invest, and the rate of return of the market.

Frequently Asked Questions

Q) What is the difference between a pension and a 401(k) plan?

A) A pension is a retirement is a retirement benefit entirely funded by employers. In the case of your pension, Granger contributes to it and your union organization manages the investment. With this type of arrangement, you have no control over the investment of the plan’s funds and pay out of promised benefits. A 401(k) plan is a retirement benefit that depends on your own contributions and employer matching funds. You have full control of how much you invest, how your funds are invested, and your account balance increases over time.

Q) How do taxes apply to my 401(k) plan?

A) With a Roth 401(k), you contribute after-tax dollars, your account grows tax-free, and you can generally make tax- and penalty-free withdrawals at age 59 ½. With a Traditional 401(k), you contribute pre-tax dollars, but withdrawals are taxed as ordinary income in the year you take a distribution.

Q) What type of investment support is available to me?

A) Granger partners with Fidelity to provide advisement on investment elections. In addition, you may choose to solicit investment advice from a private financial advisor at your discretion.

Q) How is my 6 month eligibility period affected if I leave Granger and return at a later date?

A) You are only required to meet the initial eligibility period one time. If you leave Granger after reaching the initial eligibility period, you will not be required to wait another 6 month period of time before you may resume participation in the plan.

Q) Can an employee change their mind if they opt-out?

A) Yes. If an employee decides to initially opt-out of the 401(k) plan, there is an opportunity to opt-in on January 1 or July 1 each year.

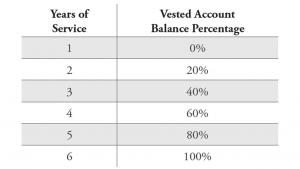

Q) What does “vesting” mean?

A) Vesting in a retirement plan means ownership of the funds. You are always fully vested in terms of the funds that you contribute to your retirement account. However, matching funds deposited by Granger vest on a percentage basis, over the course of several years. An employee who is 100% vested, owns 100% of the total balance of matching funds contributed each year. Granger Construction Company complies with the following vesting schedule.

Patient-Centric Approach

At Granger Construction, we understand that the healthcare environment is rapidly changing and no two projects are alike. We collaborate closely with clients to understand their unique clinical, technical and financial needs and keep up on industry trends and developments to provide trusted guidance every step of the way. Together, we build environments that allow healthcare providers to deliver the highest quality of healing and wellness services to the people they serve.